Medicare Part B premiums are projected to increase by over $50/month for about 30% of Medicare Part B enrollees who currently do not receive Social Security benefits. Medicare will not finalize this increase until later this fall. As of now Medicare Part B premiums are projected to increase to $159.30/month for new enrollees, enrollees who do not receive Social Security benefits, and enrollees with high incomes. The Medicare Part B premium is expected to stay the same at $104.90/month for the vast majority of enrollees who receive Social Security benefit and have their Medicare Part B deducted automatically from their monthly benefit check.

Medicare Background

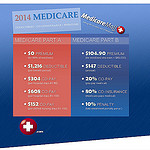

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD). The two parts of Original Medicare are Part A (hospital insurance) and Part B (physician services and outpatient care). Part A does not have a premium – you have a co-payment if you use hospital services. You pay a monthly premium for Part B. The government deducts the premium from a person’s Social Security monthly check if the person has already claimed Social Security. The 2015 Part B premium is $104.90/month if your 2013 income was less than $85,000 ($170,000 if married filing jointly). Part B premiums are higher for seniors making more money. The 2015 Part B premium can be as high as $335.70/month if your income in 2013 was above $214,000 (above $428,000 if married filing jointly).

Why is the 2016 Premium Projected to Increase so Much for Some Enrollees and Not for Others?

Medicare Part B premiums must generally equal 25% of the expected annual expenditures for all of Part B services. 2016 expenditures are expected to increase for 2016 and Part B premiums were formerly forecasted to have been $120.70 for 2016 for all enrollees, up from the current $104.90/month.

But a provision in the law is projected to distort how the 2016 Part B premium is calculated. A hold harmless provision limits the increase in the Medicare Part B premium for those enrollees who are currently receiving Social Security and have their Part B premium deducted from their monthly benefit check. This provision limits the growth in the Medicare Part B premium for these enrollees to the dollar increase in the enrollees Social Security benefit. Because the cost-of-living adjustment for Social Security benefits is expected to be 0.0% for 2016, the Medicare Part B premium will not increase above its 2015 level of $104.90/month for these enrollees.

In order to balance the Medicare program expenditures, enrollees not receiving their Social Security benefits have to make up the difference. This phenomenon is why the projected premium for those enrollees not subject to the hold harmless provision need to make up the difference. As of now, the premium is expected to be $159.30/month for 2016.

This situation is expected to reverse itself for 2017. The 2017 Part B premium is expected to increase for enrollees receiving Social Security benefits. It is expected to decrease for new enrollees, and those were subject to the big 2016 increase.

The 2016 Medicare Part B premium level won’t be finalized until later this fall so stay tuned. It could change if inflation were to increase unexpectedly and cause an increase in the cost of living adjustment to Social Security benefit.

No comments yet.