Photo by Got Credit

Over two years ago Fidelity Investments began offering several index or passive, no-fee mutual funds. The two main funds track indices of the entire domestic stock market and all of the international stock markets.

No-fee funds have the potential to increase your investment returns. Management and administration fees otherwise reduce the fund’s return.

At the time, it was revolutionary because you could invest in the US and international stock markets for free.

Interestingly, Fidelity continued to offer index funds that tracked the domestic and international stock markets but still had overhead expenses. They didn’t just swap out their expense-based index funds for their new no-fee ones.

You should focus on fees because it is one decision that is totally within the investor’s control. And lower is often better.

But now its two-years later and I wondered whether no fees translated into better returns.

By just a hair, Fidelity’s no-fee US and international stock funds returned superior performance (although only slightly) compared to similar Vanguard funds. They had a more commanding lead over the comparable funds offered by Schwab and the Fidelity funds with overhead expenses.

And we all know that past performance is not a guarantee of future performance. But, it does provide relevant information for your decision making.

Background – Index Funds

An “index fund” seeks to track a market index. The S&P 500 Index, the Russell 2000 Index, and the Wilshire 5000 Total Market Index are just a few examples of market indexes that index funds may track.

Fidelity, Vanguard, and Schwab offer mutual funds that track the entire domestic stock market and the combined international stock markets. The exact indices are different but the appeal to investors is the same – wide diversification at a very low cost.

One easy-to-implement investment approach is to use broad market indices that cover entire segments of the market rather than focusing on individual companies or industries (e.g., Apple, health care, etc.).

I like using two funds as core stock holdings – a total US stock market fund and a total international stock market fund. You can then add other stock holdings in small percentages based on your risk tolerance. But these two funds should be the bulk of your stock holdings.

So, let’s see how the competing products that track these two broad market indices have done between August 2018 and July 2020.

The Results

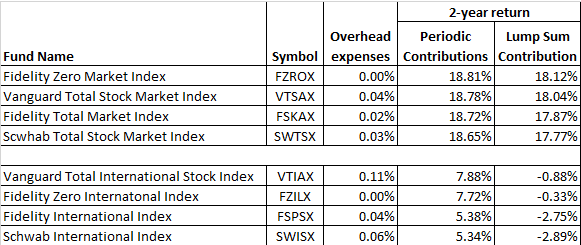

The chart shows the four US and four international stock index funds, the ticker symbol, and the overhead expenses (which are already deducted from the returns). The right-most columns show each funds’ returns using periodic contributions and a lump sum contribution on August 2, 2018.

A. Periodic Contribution Returns

If you invested equal amounts on the first of each month for 24 months (August 2018 – July 2020), then the Fidelity Zero Market Index Fund (FZROX) returned 18.81% over the two-year period. This return just barely nudged the return of the Vanguard Total Stock Market Index Fund (VTSAX) with an 18.78% return.

The Fidelity Stock Market Index (FSKAX) and the Schwab Stock Market Index Fund (SWTSX) were just behind at 18.72% and 18.65%, respectively. The takeaway was there wasn’t much difference between the four total US stock funds.

The international stock funds (the lower rows in the chart) showed greater disparity. The Vanguard Total International Stock Market Index (VTIAX) had a 7.88% return compared to the Fidelity Zero International Index Fund (FZILX) with a 7.72% return. Both of these funds far outpaced the Fidelity International Index Fund (FSPSX) and Schwab International Index Fund (SWISX).

B. Lump Sum Contribution

The chart also show the two-year return as of July 31, 2020 if you invested money on the day Fidelity offered the new funds – August 2, 2018.

The chart shows that the Fidelity Zero Market Index Fund returned 18.12% compared to 18.04% for the Vanguard Total Stock Market Index Fund. They both beat the Fidelity Total Market Index Fund and the Schwab Total Market Index Fund.

The Fidelity Zero International Index Fund also beat its rivals by only losing 0.33% as of July 31, 2020 if you invested on August 2, 2018. This fund beat all of its rivals. And it substantially bested the Schwab International Index and the Fidelity International Index Funds.

What Should You Do?

You must have a Fidelity account to invest in the no-fee funds. You can’t invest in them through another brokerage firm. And once you have a Fidelity account Fidelity can begin to market fee-based products to you! Just don’t pay attention to them.

If you already have a Fidelity IRA or Roth IRA, then you can invest in the no-fee funds and replace your higher fee funds. You can buy and sell within these tax-deferred accounts and there are no immediate tax consequences. There is no point in keeping the two Fidelity index funds that have fees. Better to replace them with the no-fee version.

If you have a Fidelity taxable brokerage account, then be mindful of the tax consequences if you sell existing funds to purchase no-fee funds. You don’t want to needlessly raise your tax liability.

If you have Schwab tax-deferred accounts, you may want to consider leaving Schwab and investing at Vanguard or Fidelity. You can purchase Vanguard and Fidelity funds at Schwab, but Schwab charges you a fee to do so. And fees only lower your returns, so stay away from anything that charges fees to invest your money.

If you are at Vanguard, then it makes sense to stay. Review them to make sure you have the Total Stock Market Fund and Total International Stock Market Fund in your tax-deferred accounts!

No comments yet.