Photo by BetterWorks

Spend a little time reviewing your employee benefits during this fall’s open season. Employers change their employee benefits annually. It makes sense to check them now because if you are like most people, you get your health, disability, and life insurance through your employer.

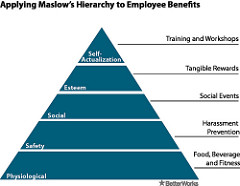

Liz Davidson in her book, “What Your Financial Advisor Isn’t Telling You” emphasizes the importance of employee benefits. She dedicates chapter one to making sure you know that your employer is often your best financial services provider! These benefits can be especially generous if you work for a large corporation or are in public service.

Most employers alter health care coverage annually. Your premium, deductible, co-pays, and in-network providers are subject to change.

Many employers have encouraged employees to switch to high deductible health plans coupled with a Health Savings Account (HSA). A high deductible plan and a HSA may be right for you depending upon your health status and likely need for health services in 2017.

Renew your flexible spending account (FSA) dollars for health and/or child care for 2017. FSA dollars allow you to pay for health or child care expenses with pre-tax dollars. But remember that FSAs are “use or lose” dollars so don’t contribute too much such that they go unused by the end of the year.

Check to see if you have commuting benefits, exercise, and/or wellness benefits such as discounted gym memberships. These small ticket items add up over time.

Your employer also may be changing the line-up of investment fund choices in your retirement plan. Look for new low-cost index funds that mirror the market’s performance. You can tell an index fund by looking at its expense ratio. It should be 0.10% or less. Use this guidance on how to decide among your investment choices.

Try to contribute the annual maximum of $18,000 to your employer retirement plan. Spread the contribution over the entire calendar year. Spreading your contributions out over every pay period ensures you receive well-earned matching funds in each pay period. If you max out your annual contributions in November then you don’t receive matching funds in December. In other words, you took a voluntary pay cut!

And if you are unable to max out on the $18,000 annual contribution, increase your contribution percentage by 50% of any raise you received in 2016. For example, if you received a 3.0% raise in 2016, increase your retirement savings by 1.5%.

If you are age 50 or more, renew your catch-up retirement plan contributions ($6,000 more per year). Catch-up contributions don’t automatically rollover from year to year.

Finally, more and more employers offer employee assistance program. Traditionally these programs focus on mental and substance abuse issue. But I’ve seen more employers offering legal help and even help with financial planning! The legal help often is a good way to get your necessary estate documents at a low price.

In sum, fall is the time of the year to take a few moments to get the employee benefits you deserve.

I truly appreciate this article.Much thanks again.

You are welcome. Thank you for reading!