Photo by LendingMemo

Portfolios of Fidelity and Vanguard stock index funds topped the 2015 performance of portfolios of actively managed funds recommended by Kiplingers, Money, and Forbes. The Fidelity portfolio’s 2015 real return topped Kiplinger’s by 0.66%, Money’s by 1.85%, and Forbes’ by 2.29%. This analysis shows that even the experts often miss picking stock funds to beat the market.

You can reduce your worry of whether you made the right fund choice by using passively managed stock mutual funds that track broad market indices. Moreover, index funds are often the lowest-cost investment choice available.

The Recommended Actively Managed Funds

The popular financial press recommends actively managed stock mutual funds in several categories. These categories include: large cap, mid cap, small cap, and international.

Money provides a list of building block funds (mostly index funds) to build portfolios. It also recommends custom actively managed funds. These funds can tilt your portfolio toward certain kinds of investments, diversify more broadly, or play a hunch. I tested the custom funds to see if they were better than the index funds offered by Fidelity and Vanguard.

Kiplinger recommends the Kiplinger 25, a list of its favorite no-load mutual. It favors funds run by seasoned managers who take a long view and have proved themselves able to weather many a storm. Kiplinger also selects funds with low to below-average fees.

Forbes recommends funds that beat their peers in both up and down markets. Forbes looked across both bull and bear markets. It selected stock funds that had done well in both environments.

Portfolio Construction and Comparison

Step one of the analysis consisted of constructing a portfolio for each magazine’s recommended stock funds and for the index funds offered by Fidelity and Vanguard. There were five portfolio in total: Kiplinger, Money, Forbes, Fidelity, and Vanguard.

Contributions in the same amount were made on the first business day of each month. This approach is called dollar-cost averaging. Dividends and distributions were reinvested. Dollar-cost averaging with automatic reinvestment is used by most retirement savers.

Each portfolio used the same asset allocation in terms of weighting domestic large, mid, and small cap and international funds:

- Large cap: 40%

- Mid cap: 24%

- Small Cap: 16%

- International: 20%

A category’s allocation was split evenly if a magazine recommended two or more funds in the category. For example, if a magazine’s recommendations included four large cap funds, each fund was weighted 10 percent to get to a 40 percent weighting.

The portfolios did not contain bond, balanced, or convertible funds due to the lack of comparability among the three magazine’s recommendations.

Step two compared the results of each of the magazine’s portfolios to those of comparable low-cost stock index funds offered by Fidelity and Vanguard.

The Results: Portfolios of Index Funds Beat Portfolios of Actively Managed Funds

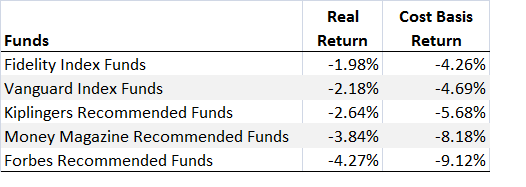

2015 was not a great year for stocks. All five portfolio lost money. The portfolio of Fidelity index funds lost the least amount. It barely nudged the portfolio of Vanguard index funds. Both Fidelity and Vanguard portfolios lost less than the portfolios of stock mutual funds recommended by Money, Kiplingers, and Forbes.

These results apply even if your portfolio only has a 60% stock allocation. The key numbers below are the percentage gains and losses – not the specific dollar amounts.

The chart below shows the results. The real return shows the compares the total contributions compared to the portfolio total on December 31, 2015. The cost basis return includes the dividends and distributions in the amount invested. As a result, the cost basis return is lower than the real return for each portfolio. The more important figure is the real return. Under both metrics, however, Fidelity was at the top and Forbes was at the bottom.

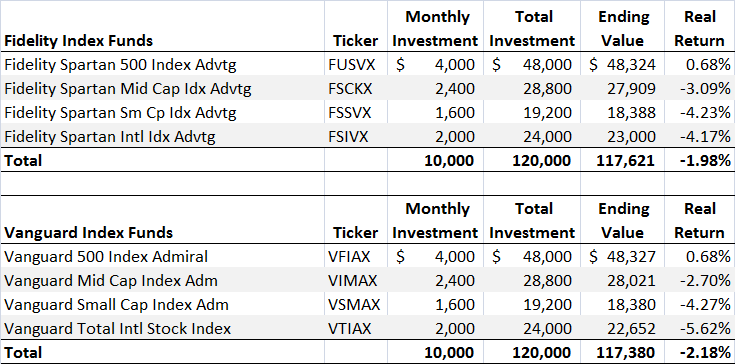

Fidelity and Vanguard Index Funds show that there was very little difference between the two. None of the four funds lost anywhere near 10 percent. Both portfolios performed about the same with large cap stocks gaining throughout the year. The other three categories lost value in 2015.

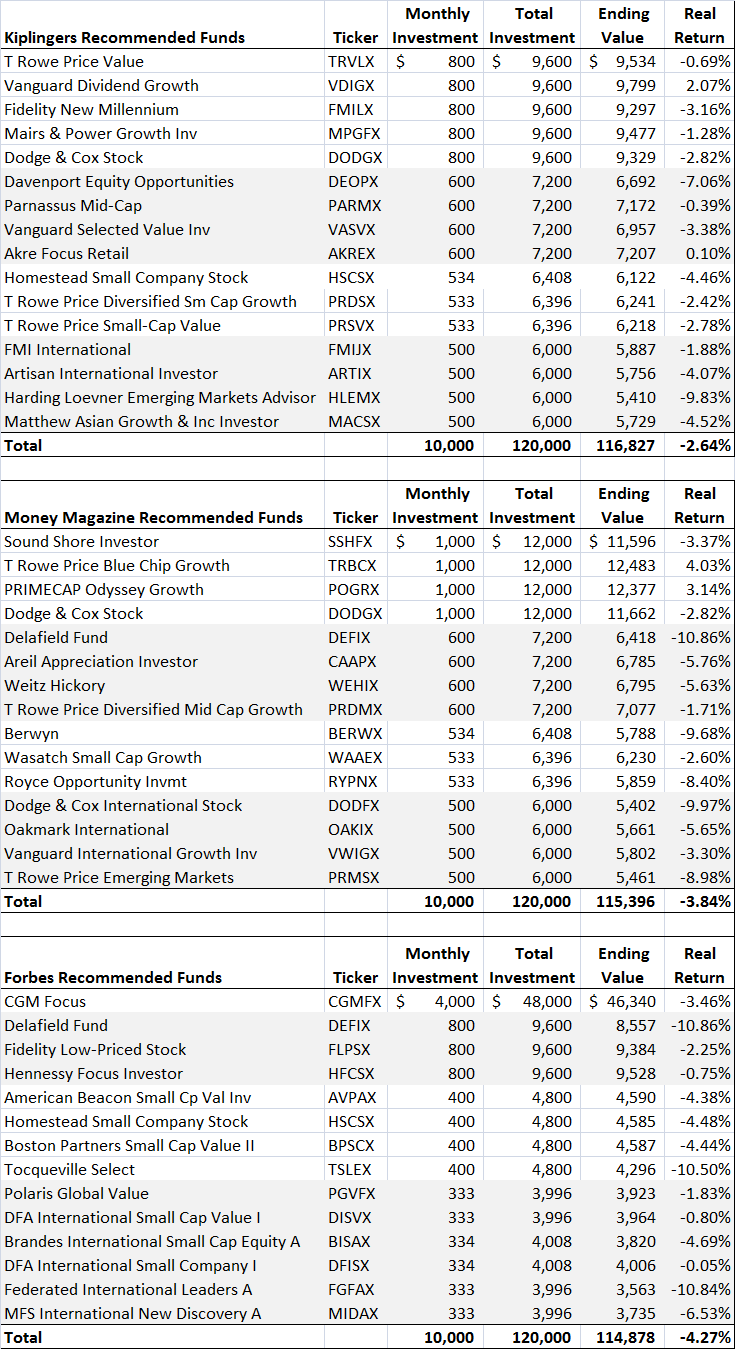

Kiplinger recommended one big winner in the Vanguard Dividend Growth Fund. Its return well exceeded the large cap index fund’s return. But it also recommended one fund that lost approximately 10 percent. This pick shows how one fund can have a substantial impact on a portfolio’s performance.

The portfolios from Kiplinger, Money, and Forbes are at the end of this post. Please note that each category of funds (e.g., large cap) is grouped together and identified by similar shading.

Money also had two large cap winners but also three other low performers. The Forbes portfolio performed the worst. The main reason was that it lacked multiple large cap funds. Its sole recommended large cap fund lost 3.5% in 2015 versus a gain for the large cap index funds of 0.7%. In addition, six of its funds had front end loads of at least 5.5%. Front end loads mean you pay just to get into the fund.

I see three takeaways from this analysis:

- Index funds take the worry out of whether you have chosen the right fund. You may not beat the market. But you certainly won’t under perform it either.

- Past performance is not an indicator of future performance. High performing actively managed funds in one year don’t mean they will perform well the next year. And of course the opposite is true too.

- Expenses matter. The Forbes list contained funds with front end loads. This fact means that a fund has to earn the load back just to break even. A tough task in any market. Choose no-load mutual funds.

No comments yet.