It is time to examine your risk tolerance or risk aversion once you’ve decided upon your investment horizon – short, medium, or long-term. Where do you start? As a rule of thumb, the longer your investment horizon, the greater volatility (ups and downs) you can weather in your portfolio. Conversely, if the horizon is short, a portfolio with lots of volatility may be inappropriate. Your portfolio could be in a trough when you really need the money and you would be forced to sell “low.”

It is time to examine your risk tolerance or risk aversion once you’ve decided upon your investment horizon – short, medium, or long-term. Where do you start? As a rule of thumb, the longer your investment horizon, the greater volatility (ups and downs) you can weather in your portfolio. Conversely, if the horizon is short, a portfolio with lots of volatility may be inappropriate. Your portfolio could be in a trough when you really need the money and you would be forced to sell “low.”

One way to express your risk tolerance is how you allocate your portfolio among cash, bonds, and stocks. Although you can add other investments such as real estate and commodities, I’ll stick with cash, bonds, and stocks to simplify the discussion.

How much cash you hold is often based on making sure you have an appropriate emergency fund or sufficient reserves for upcoming expenses. But how do you allocate the remainder of your money between bonds and stocks? Although there are many quizzes and questionnaires available to determine your risk tolerance, I find two data points can help inform this decision.

Stocks Outperform Bonds but have More Volatility

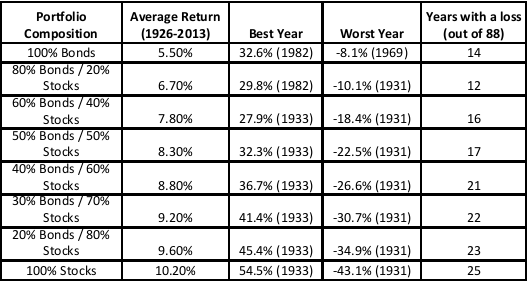

Stocks have historically returned more than bonds. On average, stocks have returned 10.2% per year from 1926 – 2013, according to the Vanguard Group. Bonds, however, have returned an average of 5.5% over the same time period, about half of the return of stocks. The more you have in stocks, the greater the return (earnings) but it comes with more ups and downs. Between 1926 and 2013, there have been 25 years in which stocks lost value and bonds had 14 years in which they lost value. So stocks have had more ups and downs than bonds.

The Vanguard Group has analyzed the annual return (earnings) between 1926 and 2013 of portfolios with different percentages of stocks and bonds. The chart below also shows the best and worst years and the number of years in which the portfolio lost value. Vanguard constructed the portfolios using the broad gauges of the market (e.g., the S&P 500). Of course, past results are not a guarantee of future performance, but the past does provide directional information on various portfolio allocations.

Historical Performance of Stocks and Bond Portfolios

Portfolios with increasing percentages of stock have better returns. They also have more years with a loss. Moreover, the gains and losses in the best and worst years increase with a greater percentage of a portfolio invested in stocks. So once you have at least 70% of your portfolio invested in stocks, you need to ask yourself can you live with the fact that your portfolio could lose value one out of every fours years on average?

Five Year Tipping Point for Mixed Portfolios

Although average annual information is helpful, it doesn’t tell the whole story. Average annual data does not consider how these portfolios have performed over consecutive years. One client told me how he remembered years in which his portfolio was flat and he was reluctant to invest in the market again for fear of the same phenomenon.

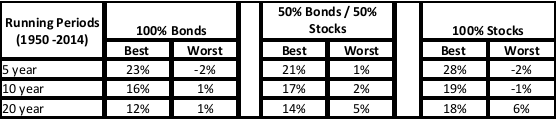

An analysis by J.P. Morgan shows how rolling time periods can shed some light on how often these flat or declining periods last. The chart below show the best and worst 5-year, 10-year, and 20-year rolling periods. The best 5-year period between 1950 and 2013 for a 100% bond portfolio was 23% annual return per year. To determine the best 5-year period, J.P. Morgan examine each rolling 5-year period (1950-54, 1951-55, 1952-56, etc.). Likewise, the best 5-year period was a 50% bonds / 50% stocks portfolio was 21% and the worst was 1%.

Source: J.P. Morgan Guide

There has not been a period of five consecutive years during the 1950-2014 time period in which a portfolio of 50% bonds and 50% lost money.

This five-year rule is a helpful guide on how to allocate your money depending upon your investment horizon. For example, it may be best to stay out of the market if you are very uncomfortable with risk and your investment horizon is less than five years. If you are more comfortable with risk, it may be appropriate to invest a portion of your money in equal parts of bonds and stocks. The remaining portion can be invested in cash. If you have a long-term horizon (e.g., 30 years until retirement), it may appropriate to invest 100% in stocks because a portfolio of 100% has the best rolling 20-year results, albeit with the most volatility.

Another takeaway from this chart is that a mixed portfolio of stock and bonds reduces volatility. This reduction in risk occurs because stocks and bonds don’t necessarily move up and down together. As one goes up the other may go down. Indeed, bonds and big company stocks have historically been negatively correlated. So over the long-term a diversified portfolio has worked to produce the greatest returns with lower volatility.

Keep these two points in mind as you determine your risk tolerance and allocate your portfolio among stocks and bonds.

No comments yet.