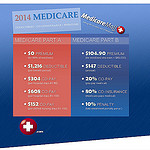

Medicare Part B premiums are projected to increase by over $50/month for about 30% of Medicare Part B enrollees who currently do not receive Social Security benefits. Medicare will not finalize this increase until later this fall. As of now Medicare Part B premiums are projected to increase to $159.30/month for new enrollees, enrollees who […]