Tony Robbins’ describes ideal investor behaviors in “Money Master the Game” that can maximize your investment performance.

Tony Robbins’ describes ideal investor behaviors in “Money Master the Game” that can maximize your investment performance.

The book’s first half centers on the tasks and new habits you should follow to achieve financial freedom. New habits like setting up automatic savings and eliminating unnecessary expenses.

The second half of the book relays the investment secrets of “what the most successful investors in history believe and practice.” He discusses the investment approaches of several well-known investors such as John Bogle (Vanguard), Ray Dalio (Bridgewater), and David Swensen (Yale University) among others.

Before describing their approaches, however, he summarizes ideal investor behaviors that are actually more important than any of the investment approaches he reviews.

I describe below the ideal investor behaviors and the investment approaches he discusses. I close with some thoughts on how you can use this information.

Ideal Investor Behaviors

It’s important to understand that the average investor’s performance is abysmal compared to the market.

According to JP Morgan, the average investor’s return was 2.1% compared to the S&P 500’s average annual return of 8.2% over the past 20 years. More than a six percent difference per year over 20 years is huge.

Robbins describes five successful behaviors that can help average investors improve their returns and that don’t cost anything!

1. Asset allocation matters

In a very basic form, asset allocation is the percentage of stocks and bonds in your portfolio. Stocks have earned more than bonds over time, but have more ups and downs (greater volatility).

Determine your portfolio’s target asset allocation based on when you need the money and whether you can stomach the ups and downs of the stock market.

More stocks are right if you need the money in 20 to 30 years (e.g., your retirement funds). Conversely, more bonds are right if you need the money for a home down payment in two to three years.

2. Don’t chase returns

Avoid chasing returns by investing in investments that recently performed well. Past performance is just that – past. Set your asset allocation and don’t keep fiddling with it based on lists of “top” performing mutual funds or “hot” tips.

3. Keep fees low

Investment fees (and expense ratios in mutual funds) matter. So keep them low and well under 1.0%.

Research shows that mutual funds with “active” management (those that try to pick the best companies) do not outperform indices of the market. And actively managed mutual funds generally have expense ratios of around 1.0%.

Rather than trying to choose the “best” actively managed mutual fund, invest instead in index funds with their low fees (fees as low as 0.05%).

4. Use dollar-cost averaging

Dollar-cost averaging is a good way to buy into the market gradually. For example, invest the same amount every month based on your target asset allocation.

Sometimes you will buy high. Sometimes you will buy low. Not every security is up (or down) at the same time so dollar cost averaging helps even things out. And remember to keep investing during the rough patches.

5. Rebalance annually

Rebalance your portfolio back to your target asset allocation at specific intervals, such as once per year. Rebalancing reduces the risk that you bought at the wrong time. You bring your portfolio back into the risk level that you want.

For example, if your target allocation is 70% stocks / 30% bonds and your stocks now account for 75% of the portfolio, sell the 5% of stocks and buy 5% of bonds. You will be selling “high” and buying “low” – which is the real key to investing.

These are the behaviors that matter. They will decide whether your return is more like the 2.1% of the average investor or more like the 7 to 8% that you really want.

More on Asset Allocation

The first and most important decision is the percentage of your portfolio to allocate to stocks and bonds. And secondarily how to decide among the various classes of stocks and bonds given the wide range of low-cost index funds available?

Robbins outlines his preferred “all seasons” approach to asset allocation. He likes it because it lowers the ups and downs and still packs a good punch.

Ray Dalio (Bridgewater Associate) described this approach to Robbins. Dalio outlined four different possible investment environments, or economic seasons, that ultimately affect whether investments go up or down. And since we don’t know when each season will occur, you should have equal weights in each of them. The four seasons are:

- higher than expected inflation,

- lower than expected inflation,

- higher than expected economic growth, and

- lower than expected economic growth.

Dalio suggests you should allocate your assets such that 25% of your risk is split into each of these four categories.

The types of investments that do well in each of these seasons are:

- rising inflation: Commodities/ Gold, TIPS (Treasury inflation-protected bonds);

- falling inflation (deflation): Treasury Bonds, Stocks;

- rising economic growth: Stocks, Corporate Bonds, Commodities/ Gold; and

- falling economic growth: TIPS.

In constructing a portfolio that is sustainable through each season, Dalio recommended the following asset allocation:

- 30% Stocks (index fund of the total US stock market)

- 55% Bonds (higher because stocks are three times more volatile than bonds)

– 15% Intermediate US Bonds

– 40% Long-Term US Bonds - 7.5% Gold (will perform well with accelerated inflation)

- 7.5% Commodities (will perform well with accelerated inflation)

Robbins provides evidence on the benefits of this asset allocation. He indicated that it outperformed the S&P 500 with an average annualized return of 9.72% (net of fees) over 30 years (1984 through 2013). There were only four down years during those 30 years (down only 3.93% in 2008 – the Great Recession). It also performed well in 2014 (15.36%) and 2015 (-2.02%).

Robbins also outlines the asset allocation approach of two other all-star investors. Each approach not explained as nicely, but still very elegant. The simplest approach attributed to Jack Bogle’s (the founder of Vanguard) with only two funds.

- 65% US Total Stock Index

- 35% US Total Bond Market Index

He also reviews the asset allocation approach of David Swenson (chief investment officer of Yale University).

- 20% US Total Stock Index

- 20% Developed (Foreign) Markets Index

- 20% US REITS Index (Real Estate)

- 15% Long-term US Treasuries Index

- 15% US TIPS Index (Inflation Protected Treasuries)

- 10% Emerging Markets Stock Index

Comparison of the Three Asset Allocation Approaches

I thought it would be interesting to see how the average investor would fare under these three approaches. I replicated them using low-cost Vanguard funds from the earliest possible date in which all the funds were available. This period started on March 1, 2004 (the twelve-year period) and ended September 30, 2016.

I also performed an analysis of the last 10 years (October 1, 2006 through September 30, 2016) (the ten-year period). Although these measurement periods are not as long as those Robbins examined, they seem reasonable given the products available to retail investors.

The analysis used a dollar-cost averaging approach – it contributed a constant amount to each fund in the portfolio on the first day of each month. The analysis re-balanced the portfolio back to the target allocation on the first day of each year.

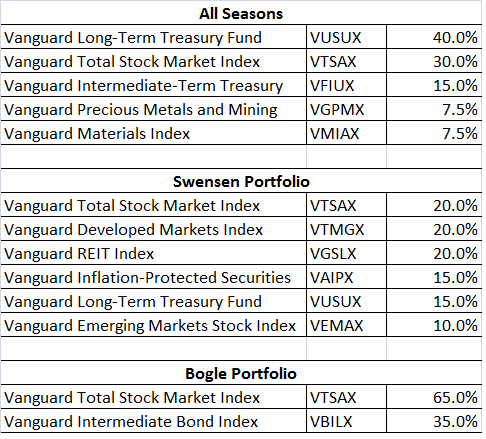

The chart below shows the funds in each portfolio and the percentage of the monthly contribution.

Each portfolio had an average annual return of between 7.9% and 8.6% over the twelve-year period. The average annual return for the ten-year period was wider at 7.6% and 9.1%. These annual returns are a far cry from the average investor’s return of 2.1%.

The All Seasons portfolio had the least volatility. Its greatest loss in 2008 was about 50% of the annual loss of the other two portfolios in 2008. And conversely, its best year was only 60% of the best year of the other two portfolios.

I specifically have not put in the portfolio’s returns and rankings because they are highly dependent upon the time period measured. The interesting thing was that the annual return changed for the same year based on the measurement period used.

Why?

The answer is math. If you start investing at a market high, you have more ground to make up if a loss suddenly occurs. For example, the 2008 loss in the Bogle portfolio was worse in the ten-year period compared to the twelve-year period because more was at stake in the ten-year portfolio as a percentage of the portfolio.

Despite these issues, several qualitative points emerged from the analysis.

Takeaways About Asset Allocation

1. A steadier ride with shallower lows and tepid highs will include more bonds (especially long-term bonds).

2. Stocks have had a greater annual return compared to bonds but more ups and downs (some of them pretty big).

3. If your portfolio has a high allocation of bonds (over 50%), diversify that allocation by including long-term treasury, inflation protected, and intermediate-term bonds. If the portfolio is light on bonds, its fine to use one intermediate-term bond fund.

4. If your portfolio has a high allocation of stocks (over 50%), diversify that allocation by including real estate and international stock exposure. If the portfolio is light on stocks, its fine to use one total stock market fund.

5. You can use different asset allocations for the varied investment accounts you may have. For example, you may have an employer 401k, a rollover IRA, and a college savings fund. You may want to use one of the asset allocations for the 401k, another for the rollover IRA, and yet another for the college savings fund. This way you manage each account separately and you hedge your bets as to which one will do best. One size does not fit all.

In sum, all three portfolios performed nearly the same over the measurement periods despite their different asset allocations. The reason is the analysis used the five important investor behaviors of setting an asset allocation, not chasing returns, keeping fees low, dollar-cost averaging, and annual rebalancing. These behaviors are what matter to achieving high returns.

Great article. Valuable tips.

I truly appreciate this article.Much thanks again.