Carefirst’s 2018 health plan premiums for DC Health Link plans are unnecessarily high, discriminatory, and likely to distort consumer decision-making. The expected number of buyers of the plan, and not the plan’s features, drives the proposed premium increases.

Carefirst’s 2018 health plan premiums for DC Health Link plans are unnecessarily high, discriminatory, and likely to distort consumer decision-making. The expected number of buyers of the plan, and not the plan’s features, drives the proposed premium increases.

DC should review Carefirst’s 2018 premiums with an eye towards how consumers buy health insurance. Consumers view HMO and PPO products offered by the same company as substitutes. Premiums for less flexible HMO plans, therefore, should be lower than more generous PPO plans. Moreover, the same product (e.g., HMO bronze plan) should cost the same regardless of whether the consumer buys it in the individual or small group market.

In addition, DC should scrutinize the drivers of Carefirst’s premium increases. The reasons for the proposed increases seem inconsistent across products and markets and they are not fully explained in the public filings.

This review is independent of efforts to overhaul the Affordable Care Act now underway in Congress. DC should not miss this opportunity to make sure that Carefirst’s 2018 premiums are reasonable, fair, and make sense to consumers.

Background

The Affordable Care Act requires state insurance departments to review health plan premium increases for individuals and small employers. These two groups are the most vulnerable to unfair increases. They do not have the same negotiating leverage as larger groups with more than 100 employees.

Insurers propose different premiums for the same product in the individual and small group markets because DC regulations require insurers to price these two groups separately. There is no economic reason the two markets can’t be unified. Consumers have no idea that the same product could be priced differently just because they are self-employed and not working at a small business.

The DC Insurance Bureau evaluates proposed premium increases for reasonableness. Reasonable premiums are adequate to cover the costs of paying for medical services claims and for operating the company. Premiums cannot be excessive and unfairly discriminatory. The Bureau also looks at the adequacy of the reasoning behind the insurer’s premium increase.

DC Health Insurance Landscape

CareFirst BlueCross BlueShield is the largest insurer on the DC Health Link. It provides health insurance plans in the both the individual and small group markets to over 73,000 persons. Kaiser Foundation Health Plan is second, with 6,366 covered lives.

This blog focuses on CareFirst’s proposal because it is the largest supplier on the DC Health Link.

CareFirst actually operates in DC using two companies – CareFirst BlueChoice, Inc. and Group Hospitalization and Medical Services, Inc. (GHMSI). GHMSI is an independent licensee of the Blue Cross and Blue Shield Association. It operates, however, under the CareFirst corporate structure. Indeed, the same corporate department filed both companies’ premium requests.

CareFirst offers BlueChoice plans, which are Health Maintenance (HMO) plans. GHMSI offers BluePreferred plans, which include Preferred Providers Organizations (PPOs).

This plan distinction is important.

An HMO gives the plan member access to certain doctors and hospitals within the insurer’s network. A network includes providers that have agreed to lower their rates for plan members and meet quality standards. Care under an HMO plan is covered only if the doctor or hospital is in that HMO’s network. There are few opportunities to see a non-network doctor. There are typically more restrictions for coverage under an HMO than other plans, such as a limited number of visits, tests, or treatments.

PPO plans, by contrast, offer more flexibility when picking a doctor or hospital. They also feature a network of providers, but there are fewer restrictions on seeing non-network providers. In addition, PPO plans will pay for non-network providers, although it may be at a lower rate than in-network providers.

HMOs tend to be more affordable, but usually give less coverage and more restrictions. PPOs are more flexible and offer greater coverage, but come with a higher premium.

Consumers buy health plans by comparing the plan type (HMO or PPO) with the monthly premium and annual deductible. Younger and/or healthier folks often find an HMO more affordable because they do not have health issues that require a lot of medical care. But other folks with health issues or pre-established doctor relationships may want a PPO for more flexibility.

Carefirst offers both types of plans as high-quality “Blue” plans. The reputation of an insurer with “Blue” in its name, regardless of whether the word “Choice” or “Preferred” follows the word “Blue,” provides informational benefits to consumers. It leads them to believe the plans are offered by the same company. The company will pay their claims when they get medical services.

As a result, consumers readily substitute Carefirst HMO for PPO plans (and vice versa). Accordingly, DC regulators should evaluate the proposed premiums for reasonableness recognizing this consumer behavior.

Carefirst’s 2018 Health Plan Premiums

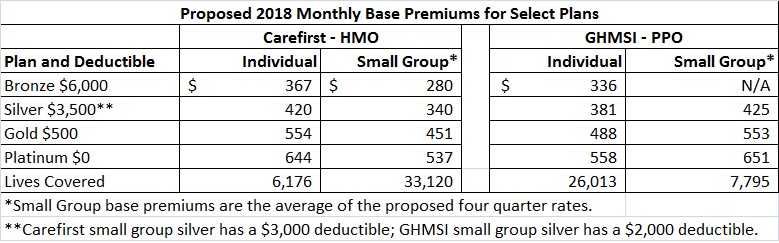

The chart below shows the proposed 2018 monthly premium rates for a comparable sample of Carefirst’s bronze, silver, gold, and platinum plans on the DC Health Link. The chart shows the base premiums for Carefirst HMO and GHMSI PPO plans for the individual and small group markets. The bottom row shows the number of covered lives for each product (HMO v. PPO) and market (individual v. small group).

The base premium is the premium for a 40-year old. Premiums for younger purchasers are 27% lower than the base premium. Premiums for 64-year olds are 218% higher than the base premium.

The number of covered lives (i.e., the size of the pool) appears to drive the proposed premiums.

1. The PPO products in the individual market are less expensive than the HMO in the individual market. For example, a PPO silver plan’s premium is $381 compared to the HMO silver premium of $420. The opposite holds for the small group market where the HMO plans are less expensive than the PPO plans.

2. Among the HMO products, small group participants pay less than the individual market participants for the same plan. The opposite holds for PPO plans. Small group participants pay more for the same plan than individual market participants.

3. The lowest premiums (small group HMO plan and individual PPO plans) are those that have the largest number of covered lives. This makes sense because high costs of any one member are spread over a larger population.

The larger pool size distorts market signals by pricing PPO plans lower than HMO plans in the individual market. This upside down pricing distorts consumer expectations that PPO plans should cost more than HMO plans. Consumers will rightfully buy low-cost PPO plans instead of high-cost HMO plans, because consumers view them a substitutes offered by Blue Cross Blue Shield.

Moreover, it is unfairly discriminatory to base the premium differences for same plan in the individual and small group markets based on the number of covered lives. The proposed premiums are likely to drive people away from the individual HMO plans and small group PPO plans. Thus their pool size in 2019 will be smaller than in 2018 and hence potential rate increases for 2019 are likely to be even bigger than 2018 for the smaller pools.

DC should assess the reasonableness of Carefirst’s proposed premiums by making sure :

- HMO plans are less expensive than PPO plans and

- purchasers of the same plan pay the same premium, regardless of whether they are in the individual or small group market.

The remedy is to unify the premium calculation over all covered lives because consumers see these products as substitutes. Instead of four pools of between 6,000 and 33,000 lives, there should be one pool of 73,000 lives. By doing so, consumers will receive correct price signals to choose the health plans that meet their needs.

Drivers of Carefirst’s 2018 Health Plan Premium Increases

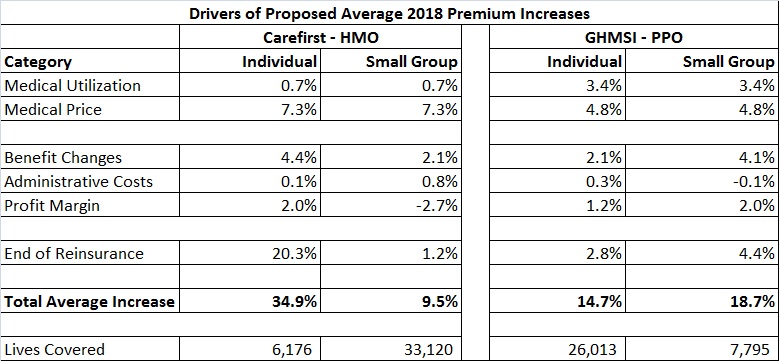

A look at the drivers of Carefirst’s 2018 health plan premium increases further supports unifying the pools for “Blue” products and markets offered on the DC Health Link. The chart below shows the drivers of the premium increases.

Carefirst has proposed to increase the 2018 premium for its HMO plan in the individual market by an average of 34.9% over its 2017 premium. But it has proposed a smaller increase of 9.5% for the small group HMO plans. Conversely, Carefirst has proposed a bigger increase of 18.7% for small group PPO plans compared to 14.7% for individual market.

Carefirst has proposed smaller increases for plans with more covered lives and bigger increases for plans with fewer covered lives.

Now let’s look at the specific drivers of the proposed increases. Each driver raises questions that DC should scrutinize.

1. Medical Utilization measures the volume of services used by plan members.

Carefirst’s proposal suggests that PPO plan members are using more services than HMO plan members (a 3.4% increase for PPO plans but only a 0.7% increase for HMO plans). DC should verify whether there is a difference in the past experience to prove this disparity.

2. Medical Price measures increases in prices that Carefirst pays to physicians, hospitals, and other providers. Carefirst has proposed a 7.3% increase for HMO plans but a smaller 4.8% increase for PPO plans.

These proposed increases don’t make sense. HMOs are likely to have lower costs because the provider group (the physician or hospital) is in a guaranteed relationship with the insurer. The disparity in medical prices begs the question of whether the PPO negotiating and legal team has been able to strike better deals with providers than the HMO team. This is odd since they are both the same company.

Even a 4.8% increase is high given that consumer inflation has not exceeded 2.0% for the rest of the economy over the last five years. Are HMO physicians getting a 7.3% raise?

3. Benefit Changes measures the cost of plan features. Carefirst has proposed to increase the premium between two and four percent for features that are not mandated by law.

The proposed filings don’t describe in narrative form the benefit changes and why they are reasonable. In addition, it seems implausible that a benefit increase for HMO plans should raise the premium by 4.4% for plans in the individual market but only 2.1% for the same plan in the small group market.

4. Administrative Cost measures changes in Carefirst’s costs of doing business.

Carefirst has proposed small changes of between -0.1% to 0.8% across all of its plans. What justifies the administrative cost differences among plans? There are no plan-specific marketing costs because they are offered on the DC Health Link. Moreover, call center, claim processing, and legal/corporate costs are all unified under the Carefirst umbrella and are not different based on the plan type or market segment.

5. Profit Margin changes measure Carefirst’s profits.

Why are some profit margins going down (small group HMO down 2.7%) while others are increasing (individual HMO up 2.0%). Again the number of covered lives seems to distort these proposed changes.

6. End of Reinsurance measures support provided by the federal government. This is the main reason for the whopping HMO premium increase in the individual market. Carefirst proposed a 20.3% increase for individual HMO products but only an increase between 1.2% and 4.4% for all other products.

Why countenance such a drastic price increase on the product covering the fewest lives? This seems unfairly discriminatory to consumers who have purchased the traditionally less expensive plan. The better answer is to end the anomalies that distort these premiums by unifying the premium development across substitutable products and markets.

—

In sum, DC should use its regulatory authority to ensure fair and economically rational premiums for Carefirst health plans sold on DC Health Link.

No comments yet.