Many young families need term life insurance protection because they now have mortgages to repay, children to support, and college educations to fund. So how do you decide how much coverage you need? This question can be vexing because as you grow older, you are saving more money, paying down your mortgage, and setting aside money for college.

Often folks purchase level policies, that is, $750,000 for 20 years. But that approach often over-insures the out years when you don’t need as much coverage because your debts are lower and your savings are higher. The amount of coverage you need is like a downward staircase – higher coverage in the beginning and lower coverage as you grow older. In other cases, permanent life insurance may be appropriate for the later years.

Put together a schedule that shows your likely liabilities in five-year increments. In other words, how much will you need today, 5 years from now, 10 years from now, etc. In general, I suggest term life insurance to pay off your mortgage, to cover 2 years of cash expenses, and to fund your children’s college education. Purchase several term life insurance policies of different lengths to match your declining need. The policies can be stacked and formed into a downward staircase.

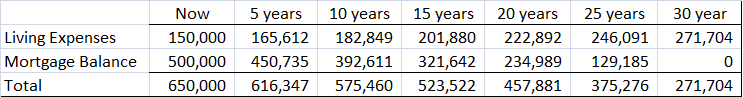

For example, you may have a 30-year mortgage of $500,000 at 4.0%. Your expenses run about $75,000 year and inflation is running about 2.0% per year. So put together a showing how much your liability is at five-year increments. Table 1 shows how much coverage would be needed now and at five-year increments.

Table 1: Example of Projected Expenses at Five-Year Intervals

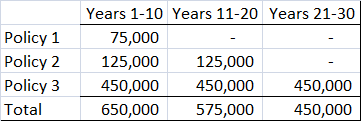

In this example, you need at least $650,000 in coverage for 10 years (see the Total row in Table 1), around $575,000 for years 10-20, and about $450,000 years 20-30. So I would not suggest that you buy a $650,000 policy for 30 years, but rather a $450,000 policy for 30 years, a $125,000 policy for 20 years, and a $75,000 policy for 10 years. The chart below stacks these policies to form a downward staircase.

Table 2: Stacked Term Life Insurance Policies

One last point, purchase the policies from different insurers. By doing so, you are spreading your risk out should one of the insurers fail. Its better not to put all of your life insurance eggs in one basket.

In sum stack your term life insurance policies of different lengths into a downward staircase to obtain efficient coverage throughout your life.

No comments yet.