Once you have your student loan inventory, it is time to develop a repayment plan that makes real headway to reduce your debt and the amount of interest paid. Of course, if you can only make the minimum payments, then that is what I urge you to do.

Once you have your student loan inventory, it is time to develop a repayment plan that makes real headway to reduce your debt and the amount of interest paid. Of course, if you can only make the minimum payments, then that is what I urge you to do.

But if you have the ability pay more than the minimum monthly payments, you can use a variation of the snowball strategy. In a snowball strategy, you pay minimum payments on all of your student loans except for the one with the smallest outstanding balance. You pay any extra money to the loan with the smallest balance. Once that loan is repaid, then attack the second smallest loan by paying any extra money to that loan plus the old minimum payment from the loan you just paid off. This way, the amount of money applied to the smallest debt keeps getting bigger (like a snowball) as you pay off each loan. Keep repeating until you extinguish all of your debt.

I like the idea of the snowball. It should, however, consider the loan’s interest rate. It does not make good financial sense to pay off a loan with a low interest rate while higher interest rate loans are accruing interest. Sometimes there is a 3 to 4 percent interest rate differential, which can add up to real money! Moreover, paying off the high interest rate loans first will reduce the total amount of interest paid overall.

I suggest making the minimum payment for each loan except the loan with the highest interest rate. Apply any extra money to the student loan with the highest interest rate first. If you have two loans at the same interest rate, attack the smallest one first. Once the first loan is repaid go to the next loan by applying the first loan’s minimum payment, plus any extra to the next loan. This way the payment that goes to the loan you are targeting will be bigger and bigger after each higher-interest rate loan is paid off. The repayment snowball keeps getting bigger and bigger.

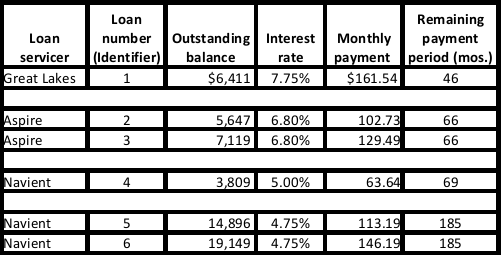

Using the hypothetical student loan inventory below, make the minimum payments on all six loans. Apply any extra money to the first loan, which has a 7.75% interest rate. Once that loan is paid off, apply the former payment of $161.54 to loan number 2 so that the monthly payment is $264.27 (161.54 + 102.73). Continue to make minimum payments on loans 3 through 6. Once loan 2 is repaid, make a bigger payment to loan 3. Keep repeating this process until all six loans are repaid.

Hypothetical Examples of a Federal Student Loan Inventory

One other thing to keep in mind, I don’t recommend this strategy if you are on the Public Service Loan Forgiveness (PSLF) Program. Under the PSLF program, the loans will be forgiven at the end of 10 years of on-time payments. Thus, it makes no sense to prepay your student loans quicker or faster if they are going to be forgiven anyway. Just make the minimum payments. It would be better to put any extra cash flow to savings or other debt repayment.

I am often asked whether a borrower could consolidate student loans and still use this snowball repayment strategy. Generally no. Consolidation loans often reduce the size of the monthly payment by extending the term of the loan beyond the 10-year repayment plan that is standard with federal loans. Unfortunately, they also eliminate the interest rate differential and the ability to repay more expensive loans faster. Consolidation loans combine several student or parent loans into one bigger loan from a single lender, which is then used to pay off the balances on the other loans. The interest rate on a consolidation loan is the weighted average of the interest rates on the loans being consolidated, rounded up to the nearest 1/8 of a percent. That interest rate is fixed for life of the loan. If you are consolidating loans with different interest rates, the weighted average interest rate will always be in between the highest and lowest interest rates.

So by combining the loans, you lose the advantage of paying the higher interest rate loan first as described above. More important, the amount of interest you pay over the lifetime of the loan will be about the same. Thus, if you have extra money that can be applied to your student loan repayment, I don’t recommend consolidating your student loans.

In sum, using a snowball strategy to pay off your student loans will melt your loans away quickly!

No comments yet.