You may be wondering what to do in a stock market sell-off (a “correction”). Domestic and international stocks have been down sharply since last Monday, August 17th. As of the market close on Tuesday, August 25th, the S&P 500, which tracks 500 of the largest US companies, was down 11.1% in six trading days, while overseas developed economies are down 8.6%. Worries about growth in China, lower oil prices, and impending interest rate increases from the Federal Reserve appear to be hitting stocks hard. Interestingly, a broad market index of the overall U.S. bond market has stayed flat over the same time period – showing that stocks and bonds don’t move together.

You may be wondering what to do in a stock market sell-off (a “correction”). Domestic and international stocks have been down sharply since last Monday, August 17th. As of the market close on Tuesday, August 25th, the S&P 500, which tracks 500 of the largest US companies, was down 11.1% in six trading days, while overseas developed economies are down 8.6%. Worries about growth in China, lower oil prices, and impending interest rate increases from the Federal Reserve appear to be hitting stocks hard. Interestingly, a broad market index of the overall U.S. bond market has stayed flat over the same time period – showing that stocks and bonds don’t move together.

So what are investors to do with this news? Stay calm and carry on.

Most young professionals and those 10 or more years away from tapping their retirement savings should not be concerned about these developments. Sell-offs are always unnerving, but generally the best response is no response. As long as your portfolio is well diversified then the best course of action is to stay the course. One client described market downturns as those times when you just have to hold your nose and wait for the odor to pass.

Staying the course means maintaining your automatic contributions to your brokerage and/or retirement accounts at your current stock/bond allocation. You will be buying your stocks at lower prices, which over the long-term is a good thing. It doesn’t make sense to shift your stock/bond allocation to a more conservative one (e.g., one with more bonds and fewer stocks) because you may be missing the opportunity to buy low.

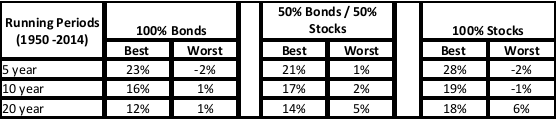

Although no one knows how low the market will go this time, historical stock market data can provide some context. An analysis by J.P. Morgan shows how rolling time periods can shed some light on how often flat or declining periods last. In other words, how long do you have to keep holding your nose.

The chart below show the best and worst 5-year, 10-year, and 20-year rolling periods. The worst 5-year period between 1950 and 2014 for a 50% bond / 50% stock portfolio was 1% annual return per year. To determine the worst 5-year period, J.P. Morgan examined each rolling 5-year period (1950-54, 1951-55, 1952-56, etc.). Likewise, the best 5-year period was a 50% bonds / 50% stocks portfolio was 21%.

In fact the historical market data show that even in severe downturns there has not been a five-year period in which a balanced portfolio has lost money. So if history is any guide, a downturn is unlikely to last longer than five years. And during that period, if you still are buying you will be buying at a lower price.

Try not to fixate on the news. Don’t do any rash moves such as getting out of equities. Indeed, the very recent data shows that stocks and bonds do not move together and often they move in opposite directions. So during this stock market sell-off, stay calm and carry on.

No comments yet.