Auto insurers can use your credit score in Maryland, Virginia, and DC to calculate your premium – irrespective of your driving record. A recent Consumer Reports investigation uncovered how your credit score can have a bigger influence on your premium than your driving record. In addition, Consumer Reports found that in some states (including Virginia and DC, but not Maryland) insurers can charge you more if you stay with the insurer. In other words, if you aren’t likely to shop around for a new policy, the insurer will charge you a higher premium by staying with the insurer. The bottom line is that even if you like your auto insurance, it pays to shop to see if you are still getting a good deal.

Auto Insurance Basics

Auto insurance primarily protects you against unanticipated accidents that cause injury to others and damage property. I encourage you to buy sufficient coverage to protect your net worth, which includes protection against those drivers who are uninsured or underinsured. Use these four tips to help determine the amount of coverage that is appropriate. Once you have decided how much coverage you need, it is time to shop.

How Your Credit Score Can Affect Your Premium

Insurers have developed models that use your credit score to predict whether you will file a claim. People with excellent and good credit pay significantly less than people with poor credit. Although there is no universal definition, excellent credit scores are somewhere about 750 or higher (850 is the highest). Good credit scores are in the upper-600s to the mid-700s. Poor and fair credit scores are below the mid-600s.

On a national basis, Consumer Reports found that Nationwide, Allstate and Progressive were the most expensive car insurers. Geico, State Farm, and USAA were the least expensive for single men and women drivers.

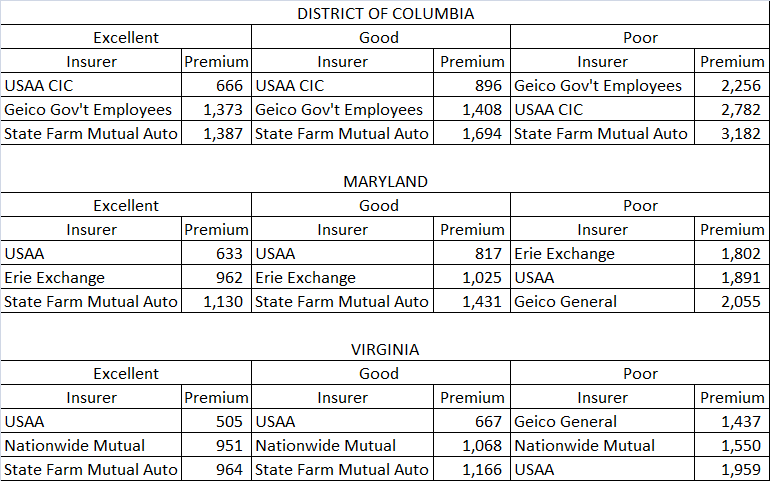

But when you look at how your credit score can impact the premium, there is a big difference in premiums. The chart below highlights how premiums can change based on a driver’s credit score for a typical new customer who is single with a clean driving record.

The insurers listed are the three in Maryland, Virginia, and DC with the largest market presence. You can see how the annual premiums increase by $200 to $300 if you have good versus excellent credit. Drivers with poor credit can expect to pay $1,000 more than drivers with good credit.

The lowest premiums are from USAA. Consumer Reports cautions that the premiums are statewide prices and that they may differ by zip code. Nonetheless, they give you a good indication of how your credit

Source: Consumer Reports

The takeaway is that it compares to shop, and to get multiple quotes from different insurers.

Insurer Loyalty Could Result in Higher Prices

The second surprising factor Consumer Reports found was that loyalty to an insurer could increase your premium. The common wisdom is that the more loyal you are to an insurer or vendor, the lower the premium or price.

But this isn’t what Consumer Reports found. In fact it was the opposite. Some insurers have figured out that if you don’t change your vendor for products such as cable tv, they know you are not price conscious. The insurer can then safely raise your premium knowing that you won’t leave. This technique is named “price optimization.” Although it certainly isn’t optimal for consumers.

Price optimization is banned in Maryland, but not in Virginia or DC. Amica Mutual and State Farm told Consumer Reports they don’t use price optimization. Representatives from Allstate, Geico, Progressive, and USAA declined to discuss price optimization with Consumer Reports.

So it pays to maintain good credit and to shop for auto insurance. You may want to look at your auto insurance policy and get quotes from at least two other insurers to see if you are getting the best deal, especially if you are with Allstate, Progressive, or Geico.

No comments yet.