Photo by LendingMemo

Repaying your student loans smartly can save money over the long term and increase your credit score. Remember: your federal and private student loans generally cannot be canceled or discharged in bankruptcy because you didn’t get the education or job you expected, or because you didn’t complete your education. So it makes sense to come up with an efficient strategy to repay them.

The first thing you need to do is to get a handle on your student loans. I recommend making an inventory or list of your loans along with their key attributes.

Federal Student Loans

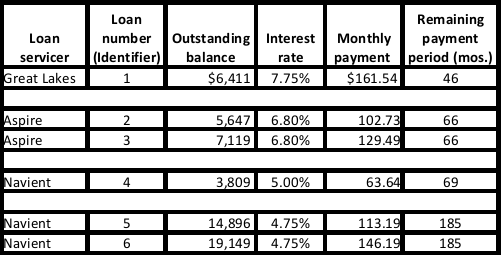

Make a chart like the one below for your government-backed loans – your Direct Student Loans (generally loans after 2007) and your Federal Family Education Loans (prior to 2007) and your Perkins Loans. The U.S. Department of Education has a database of your undergraduate and graduate loans. You will need an account and PIN to access the database, but it is a great source of information: https://www.nslds.ed.gov/nslds_SA/

Sort the loans by Interest rate and then Outstanding balance so that the top of the list has the loan with the highest interest rate with the biggest outstanding balance.

Hypothetical Example of a Federal Student Loan Inventory

Make sure to break out the loans so that you can see the loan and original loan amount. Many student loan servicers combine your loans and provide a total monthly payment. It is important in the pay off strategy to identify the loans individually. Some loans may have different interest rates. This individual breakout of loans is especially important if you have extra money available each month to pay more than the minimum monthly payment.

In most cases, these federal government-backed loans have fixed interest loans, meaning the interest rate will not change during the lifetime of the loan.

Private Student Loans: Loans Not Guaranteed by the Federal Government

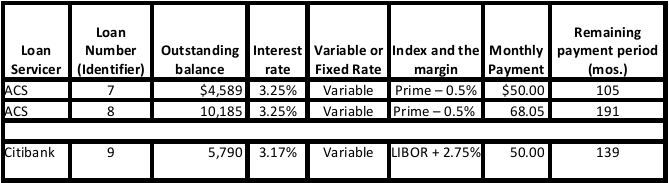

Next, put together a list of private student loans. These loans are not guaranteed by the federal government. When you borrowed the money, you may have had a co-signer such as parent or other relative. The bank used your (or your co-signer’s) credit score to establish the terms of the loan. The better your (and your co-signer’s) credit score, the lower the interest rate.

Make the same chart, but most private student loans have a variable rate. It is important to see how this rate is defined. The interest rate is usually composed of two parts – the base rate (index) and a margin. The index is bank’s cost of the money and margin is the bank’s profit margin. Check out what your index is on your loans – common indexes are the Prime Rate, LIBOR (London Interbank Offered Rate), and the 91-day Treasury Bill (T-Bill) rate. For example, a rate can be LIBOR (1 month) +2.5% or Prime Rate – 0.25%. The rate on your loans is the index rate plus the margin.

Like the federal student loan inventory above, sort the loans by Interest rate and then Outstanding balance so that the top of the list has the highest interest loan with the largest outstanding balance.

Hypothetical Example of a Private Student Loan Inventory

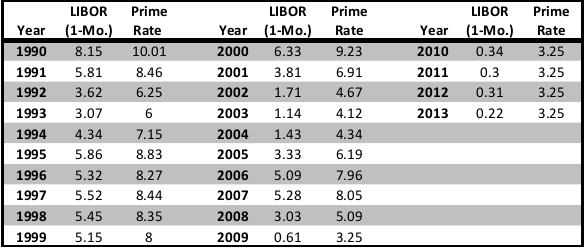

I find it helpful to check out the index value for the last several years to see how your rates could change in the future. Use this link which has the current U.S. Federal Reserve’s Statistical Release. http://www.federalreserve.gov/releases/H15/ Select the month you want and then click on the date of the month to obtain that day’s statistics. Once you have selected a date, the number on the far right of the chart is the day of the month.

Once you are on the page of rates for a particular day, there are three rows for LIBOR rates (1-month, 3-month, and 6-month) in the Eurodollars deposit (London) rows. The bank prime lending rate is in the row directly below the LIBOR rates and the Treasury bill rates are listed below the bank prime lending rates.

If you want to see historical data, such as the LIBOR rate ten years ago, use the Historical Data tab along the row right under the page title “Selected Interest Rates Weekly” (in the Federal Reserve link above). LIBOR was about 5 to 6 percent during most of the 1990s and has been 1 to 3 percent during the first decade of the 2000s. It has been near zero since the 2008-2009 financial crisis. The prime rate was 6 to 8 percent during the 1990s, 5 to 6 percent during the first decade of 2000s. It has been 3.25 percent since 2009. The chart below shows the average annual LIBOR (1 month) and Prime Bank Rates for the years 1990 through 2013.

Key Index Rates (1990 – 2013)

Source: United States Federal Reserve

If interest rates rise in the future, the low interest rates you may be paying on your private student now will increase as will your monthly payments. Indeed, the LIBOR has been around 0.30 percent for five years and the Prime Rate has been at 3.25 percent per year.

One last point, these rates vary through the year, although they have been relatively stable over the last five years. Check your private loan documents to see how often your rates can change (eg., quarterly, semi-annually, etc.).

Next week – How to best repay your student loans now that you have an inventory.

No comments yet.